Understanding CAC and LTV: The Dynamic Duo of Start-Up Metrics

Nov 03, 2023

In the high-stakes world of start-ups, understanding the language of your business's financial health is not just important – it's crucial for survival and growth.

Two acronyms that are often bandied about in boardrooms and whispered in the corridors of venture capital firms, are CAC and LTV.

But what exactly are they?

Why do they matter, particularly when you're looking to impress investors in your fundraising deck?

What are CAC and LTV?

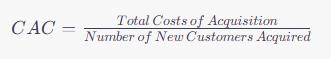

CAC stands for Customer Acquisition Cost. It represents the total cost of acquiring a new customer, including all marketing and sales expenses.

A question I often get asked, is do you include the Sales commissions / Marketing salaries / Sales salaries / Customer service costs?

The answer is depends on your business. When thinking about your P&L, ideally you want all costs that you include within your CAC to be included within your Contribution margin. So below Gross margin, but above contribution margin.

These are costs that are "variable" to a point. They increase if revenue increases BUT aren't essential to your Revenue like cost of sales are. You can turn them off if you need.

So when thinking about your salesforce and commissions if these increase when revenue does (which generally is a yes) then I would include within contribution margin and therefore CAC.

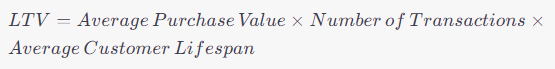

LTV, or Lifetime Value, estimates the total revenue you can expect from a single customer throughout their relationship with your company.

So what is the contribution margin for one customer and then how many times do they purchase from you over their "lifetime"?

The Importance of CAC and LTV in Fundraising

Every investor wants to put their money into a business that shows promise for growth and profitability. CAC and LTV are pivotal in painting that picture.

In your fundraising deck, showcasing a solid understanding of these metrics can demonstrate the scalability and long-term viability of your business model.

If yo know how much you can pour into marketing and get in return from you customers over time, than this can be a good way for investors to think about their returns.

Simplifying CAC and LTV Calculations

It's imperative to present these figures in a clear and straightforward manner.

Investors should be able to follow how you've arrived at your numbers without needing a magnifying glass or a decoder ring. So keep this super simple.

CAC Calculation: To calculate CAC, sum up all the costs spent on acquiring more customers (marketing expenses, sales team salaries, etc.) over a specific period, and divide it by the number of new customers acquired during that time.

LTV Calculation: Calculating LTV can be more complex, depending on the business model. A simple way is to multiply the average purchase value by the number of transactions and the average customer relationship lifespan.

So, for example, you know that every customer on average will purchase from your business twice, Revenue @ £50 per transaction, gross margin of 70% and it costs the business £25 to acquire a new customer, than your LTV is ((2 x £50) x 70%) = £70. And then if you deduct the CAC you come out with £45.

What Is a Good CAC:LTV Ratio? A healthy CAC:LTV ratio is typically considered to be 1:3 or higher, meaning the LTV is three times the CAC. This indicates that the value a customer brings is significantly higher than the cost to acquire them. It can take sometime for a start-up to get to this level but a growth model should certainly aim to get here as quickly as possible.

Incorporating a robust analysis of CAC and LTV into your expanded fundraising deck not only highlights your start-up's current performance but also forecasts its potential.

By making these calculations easily digestible, you assure investors that your company isn't just another hopeful in the start-up lottery—it's a calculated bet with a clear path to profitability.

Links:

- Get your FREE Guide: Stepping into the role of Finance Director or CFO

- Register for the mini-course, Upgrade your Management Accounts and get noticed by the business

- Work with me in the Financial Leadership Foundations course that includes monthly Q&A sessions where we can discuss all of your questions and how to apply your learnings to your current role.

- Work with me as a Founder needing guidance and support from experienced Finance leaders. Take a look at our guide on Outsourced bookkeeping.